Restez en avance avec des stratégies financières pratiques, des conseils, des actualités et des tendances.

Finance Signals: Turning market shifts into planning and close readiness

Tariffs. Foreign exchange. Interest rates. See how top finance teams turn signals into faster planning and smarter reporting.

août 15, 2025Before the numbers change, the market sends a signal. These signals—whether it’s a tariff hike, an interest rate change, or a currency swing—might not show up in your spreadsheet immediately, but they're already reshaping your forecasts, capital allocations, and cross-border revenue plans.

The real challenge isn’t just in anticipating the signal: it’s also how key finance processes like planning and close are structured. When planning and close operate in isolation, market signals arrive late, feel disconnected, and are difficult to act on swiftly.

High-performing finance teams are signal-ready. Their planning and close cycles are designed to move with the market. Anticipation is built into these cycles from the start, enabling teams to spot signals and act on them in real time—with the right tools to make it happen. And moreover, they are able to respond with “What-if?” instead of “What now?” — a true indicator of strong financial performance management.

What finance signals reveal when planning and close work together

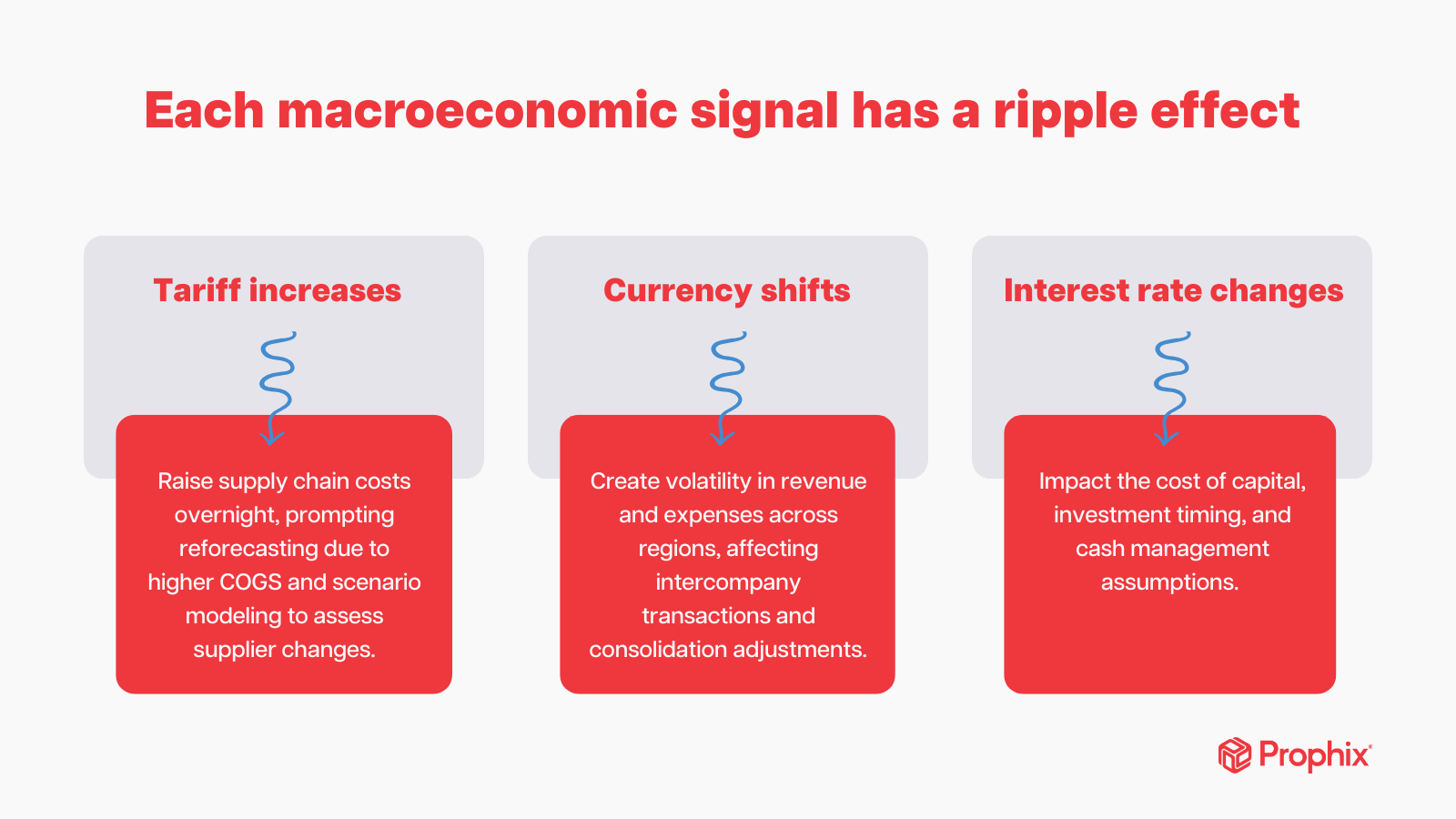

Tariffs, FX shifts, and interest rate changes don’t affect just one department. They create cross-functional ripple effects.

Finance teams are at the helm, tasked with spotting and acting on these signals before they cascade through operations, impact sourcing, margins, currency exposure, and capital costs.

The reality is, in many organizations, these signals don’t move smoothly between finance functions. They get bottlenecked—or worse, spotted too late—leaving planning and close cycles to bear the brunt of the impact.

When supplier costs spike, margin models often fail to update. When FX variance hits the ledger, forecast assumptions remain static. Signals go undetected in real-time, and planning and close cycles run in parallel instead of working in sync.

The result? Finance signals hit your planning and close cycles when it’s already too late. Being one step behind instead of two steps ahead slows you down, impacts efficiency, and undermines accuracy. You’re building your business on outdated or incomplete data.

But, when planning and close cycles work in sync and signal detection is integrated, the benefits are clear. A McKinsey study found that companies using advanced analytics in planning processes made decisions up to five times faster and cut forecasting errors by 30%.

How you can build a signal-ready finance team

Building a signal-ready finance system goes beyond staying informed about macroeconomic changes. It requires a foundational shift in how you budget, plan, and close your books.

The reality? Not every team has the time to rebuild processes from scratch. Finance is evolving from a cost center to a strategic growth engine—priorities are shifting, expectations are rising, and the pressure to keep up is relentless.

Here’s how to get your finance team ready to anticipate and act on signals as they happen today:

- Ensure planning and close cycles are closely connected

Break down silos and ensure planning and close cycles work together. Inputs from your planning cycle should inform your close process, and vice versa. Stay attuned to macroeconomic changes and their ripple effects across your core processes so you can respond in real-time.

- Use AI and automation to turn signals into faster decisions

Eliminate manual data entry and the need to dig through spreadsheets for insights or having to react after the fact. AI can automatically detect early shifts, surface key insights or anomalies, and trigger scenarios, reducing the time between signal detection and action.

- Invest in the right tech to model change before it happens

Predictive forecasting and ‘what-if’ scenarios are within reach when you have the right technology. Integrated tools can adapt your plans based on signal data—like a tariff hike or rate change—and deliver actionable insights. With ‘what-if’ modeling, you can explore every possibility and act decisively when the time comes.

What signal-ready finance looks like in practice

When signal detection is built into your planning and close cycles, your team can:

- Update assumptions in real-time: Forecasts adjust automatically when key thresholds like rate changes or cost spikes are triggered.

- See the downstream effects: A change in interest rates doesn’t sit in a line item; it flows through to project costs, investment timing, and cash flow.

- Move from reconciling to responding: Instead of backtracking to explain mismatches, you’re reallocating resources in real time and communicating with confidence.

- Stay connected across functions: With a unified process, FP&A, controllership, and operations speak the same language and act on the same data.

This isn’t about overhauling your finance function overnight. It’s about building responsive processes that learn and adapt over time. When your system sees the signal and knows how to act, planning and close become strategically aligned—and your business reaps the benefits.

Ready beats reactive

The signals are in motion: tariffs are rising and shifting trade costs, currency fluctuations are hitting margins, and interest rates are reshaping investment priorities. The question isn’t if these signals will impact you—it’s whether your finance function is signal-ready: built to react in real-time when they impact you.

With a responsive system, you’re not waiting for the numbers to change. You’re preparing for what’s next.